MIRA-CompliantInput Tax Trackingfor Maldives

Streamline your GST input tax management with AI-powered invoice extraction.

Everything You Need for MIRA Compliance

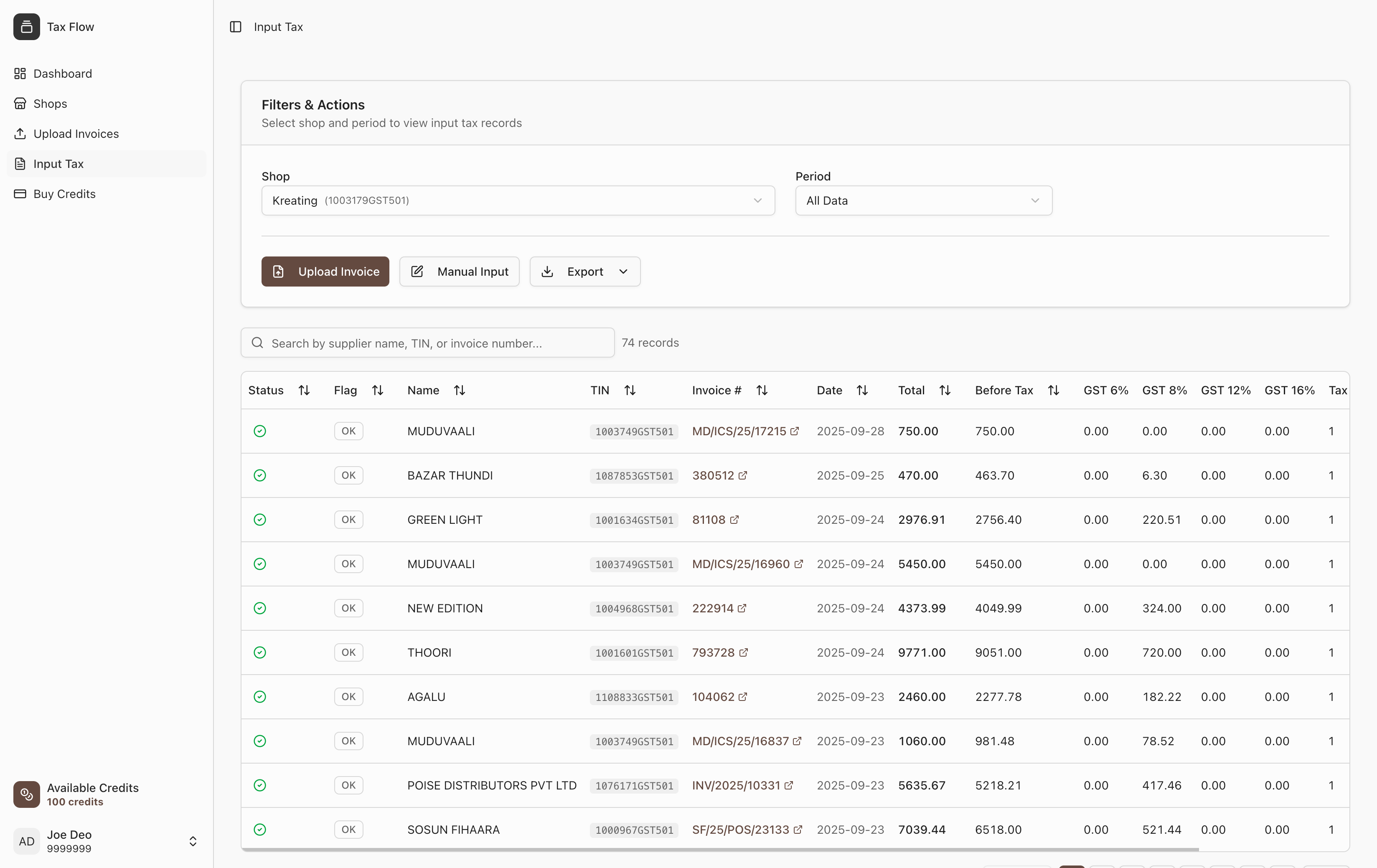

Tax Flow is built specifically for Maldives businesses to track input tax at 8% GST, manage non-GST items, and export MIRA-ready quarterly statements.

Drop file or click to upload

AI-Powered Invoice Extraction

Upload supplier invoices and let AI extract GST data automatically. Supports images and PDFs.

Q1

Q2

Q3

Q4

GST @ 8%

MVR 14,850

Non-GST (0%)

MVR 5,200

Input Tax Tracking

Track all your input tax by quarter. MIRA-compliant tracking for accurate GST claims at 8% and non-GST items.

MVR 14,850

Taxable Items

MVR 5,200

Exempt Items

GST & Non-GST Tracking

Automatically categorize invoices with Maldives 8% GST rate and track non-GST items separately for complete MIRA compliance.

Q1 Statement

Ready to export

Q2 Statement

Q3 Statement

Q4 Statement

MIRA Statement Export

Export quarterly statements in Excel format ready for MIRA submission. Statement and Online Statement formats.

MIRA compliance in 3 simple steps

From supplier invoice upload to MIRA-ready quarterly statements. AI handles the extraction, you handle the submission.

Upload Supplier Invoices

Upload supplier invoices as images or PDFs. Our system accepts all common formats for seamless processing.

AI Extracts GST Data

Advanced AI automatically extracts supplier TIN, invoice details, and identifies 8% GST and non-GST items with precision.

Export MIRA Statements

Generate quarterly Excel statements ready for MIRA submission. One-click export for Statement and Online Statement formats.

Trusted by Maldives businesses

See how Tax Flow is helping businesses across Maldives streamline MIRA compliance and save time on input tax management.

Tax Flow has transformed how we manage input tax for our retail business. The AI extracts all GST data from supplier invoices automatically - saves us hours every week!

Ahmed Hassan

@ahassan_mv

MIRA submissions used to take days. Now we just export the quarterly statement and submit. The 8% GST tracking with non-GST separation is exactly what Maldives businesses need.

Fathimath Ali

@fathimath_a

The AI extraction is incredibly accurate with Maldivian invoices. It correctly identifies supplier TINs and automatically categorizes 8% GST and non-GST items perfectly.

Ibrahim Rasheed

@ibrahim_r

Perfect for MIRA compliance. We track all our input tax by quarter and export statements in exactly the format MIRA requires. No more manual Excel work!

Aishath Mohamed

@aishath_m

As an accountant managing multiple businesses, Tax Flow is a lifesaver. Upload invoices, AI extracts everything, and quarterly reports are ready for MIRA submission.

Mohamed Zahir

@mzahir

The quarterly filtering (Q1-Q4) makes MIRA reporting so much easier. We can see all our input tax by period and export Statement or Online Statement format instantly.

Mariyam Hussain

@mariyam_h

Great platform for Maldives businesses. Handles 8% GST and non-GST items correctly, and the TIN tracking ensures we never miss a supplier invoice. MIRA compliance made simple.

Ali Hameed

@ali_hameed

Tax Flow understands Maldives tax system perfectly. The AI handles our invoice images and PDFs flawlessly, extracting amounts in MVR and all GST breakdowns.

Aminath Nashwa

@aminath_n

Automated input tax tracking has reduced our MIRA submission time by 80%. The quarterly export feature gives us exactly what we need for compliance.

Hassan Shareef

@hassan_s